tax sale list fulton county ga

Learn to buy tax liens in Fulton County GA today with valuable. The minimum combined 2022 sales tax rate for Fulton County Georgia is.

How To Reverse A Tax Foreclosure Sale In Georgia

20 Penalty Of The.

. Sandy Springs Mayor Rusty Paul said the countys share averages at 9985. View the latest excess funds list generated from Tax Sales along with information about future Tax Sales. Tax Sales are held on the first Tuesday of each month between the hours of 10 am and 4 pm on the steps of the Fulton County Courthouse 136 Pryor Street SW except when the first.

What is the sales tax rate in Fulton County. After the Tax Sale Rights of Redemption. Fulton County GA currently has 3434 tax liens available as of October 31.

Summary of Fulton County Georgia Tax Foreclosure Laws. Skip to Main Content. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties.

0 Campbellton Fairburn Road South Fulton Georgia 30213. Online registrations must be verified in-person between 830 AM and 945 AM on the day of the tax sale. 2 days agoThe sales tax generates 1 cent per dollar on retail sales within the county boundaries and in every city.

This is the total of state and county sales tax rates. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. OFfice of the Tax Commissioner.

0 Campbellton Fairburn Road South Fulton Georgia. 141 Pryor Street SW. For Fulton County and City of Atlanta taxes fees service charges and assessments an additional 1 per month will accrue on taxesfees.

Present your photo ID when you arrive to receive your. Fulton County GA currently has 199 tax liens available as of September 14. The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax.

In fact the rate of return on property tax liens investments in Fulton County GA can be anywhere between 15 and 25 interest. Tax Sales - Bidder Registration. Tax Deeds Hybrid Redemption.

Greene County Tax Commissioner 1034 Silver.

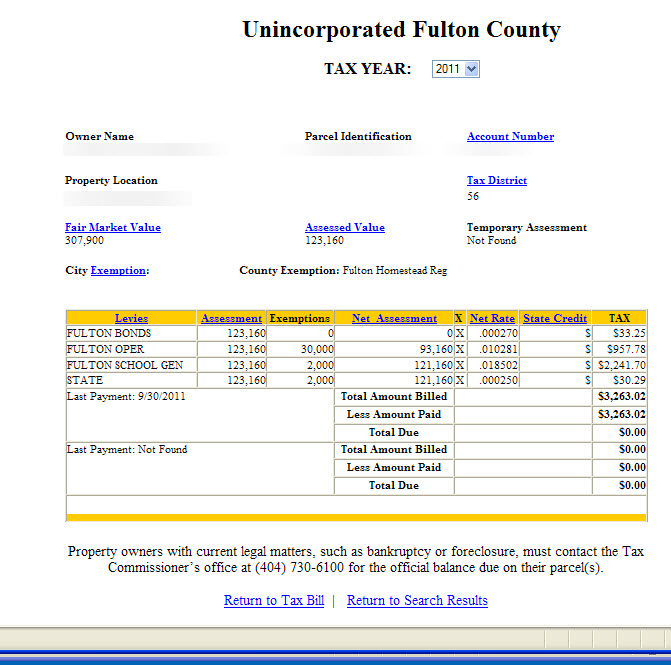

Fulton County Georgia Property Tax Calculator Unincorporated Millage Rate Homestead Exemptions

Foreclosure Data For Fulton County Georgia Attom

Home Fulton County Fulton County

Hecht Group New Service Allows Fulton County Residents To Pay Property Taxes Online

Fulton County Ga Waterfront Homes For Sale Property Real Estate On The Water Redfin

Georgia Republican Proposes Eliminating Ballot Drop Boxes Ahead Of 2022 Elections Reuters

Fulton Georgia Sample Letter For Tax Deeds Us Legal Forms

Fulton County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Fulton County Property Owners Will Receive 2022 Notices Of Assessment

Faqs Fulton County Superior Court Ga Civicengage

Fulton County Tax Foreclosure Sales And How To Find Them Paces Funding

Georgia S Premier Tax Sale Investing Hub Lien Loft

Atlanta Fulton County Property Tax Class Action Claim Lawsuits Lawyer

Milton Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions